This episode is about learning the options you have to get some money to start your startup and what is expected you achieve with that money

In this podcast series of episodes we are going to explain how to create a robotics startup step by step.

We are going to learn how to select your co-founders, your team, how to look for investors, how to test your ideas, how to get customers, how to reach your market, how to build your product… Starting from zero, how to build a successful robotics startup.

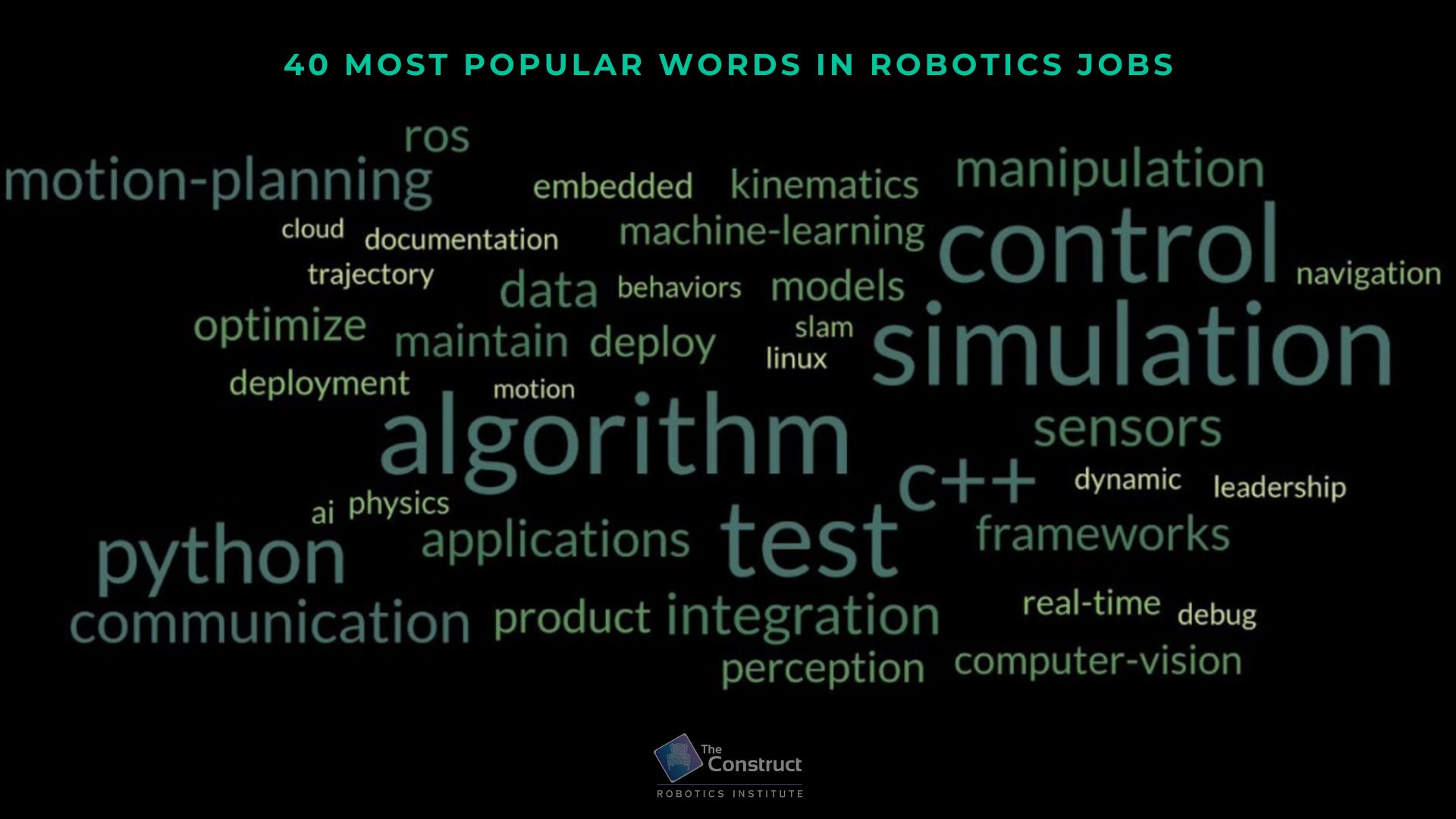

I’m Ricardo Tellez, CEO and co-founder of The Construct startup, a robotics startup at which we deliver the best learning experience to become a ROS Developer, that is, to learn how to program robots with ROS.

Our company is already 6 years long, we are a team of 15 people working around the world. We have more than 100.000 students, and tens of Universities around the world use our online academy to provide the teaching environment to their students.

We have bootstrapped our startup, but we also (unsuccessfully) tried getting investors. We have done a few pivots and finally ended at the point that we are right now.

With all this experience, I’m going to teach you how to build your own startup. And we are going to go through the process by creating ourselves another startup, so you can see in the path how to create your own. So you are going to witness the creation of such robotics startup.

Money to Start

We have an idea for a cool robotics product and assembled a team to build it. The only thing that remains is to have some money to buy the required parts, computers, and software, or else we may need to build the product. Also, the team building needs to have some payment (or not). If you need to subcontract any service (for example, the design of a logo for the product or a promotional website), or if you need to visit some places to promote it, for all that, you will need money.

The beginning of the startup is always a difficult time because the product still has not been built, so you cannot generate any money. Hence it looks like a circle: you cannot create the product because you don’t have any money being generated, and you don’t generate any money because you don’t have a product. So how do you break that cycle?

Ideas are Worthless

If you have seen all those movies about entrepreneurs, they go to a panel of investors, present their idea, and then everybody gets excited about the idea they propose and gives them the money they need.

Nothing is farther from reality.

You are not going to get money from investors based on your idea. Ideas are worthless.

There is a common misconception about the value of ideas. I myself had this misconception. Several times, I have seen people that say, “Hey, I have a very cool idea for a startup. I tell you the idea, you implement it, and we share ownership 50-50.” I’m pretty sure that your idea is very cool, but what really matters is the implementation of the ideas. The difficult part is to bring into reality an idea. I can assure you that all of us have very cool ideas.

Do you remember the concept of Discmans? Only 24 songs on a CD. Only 24! So a friend of mine shared the idea of the MP3 Discman before the idea was for sale. However, he didn’t become a millionaire selling MP3 Discmans. Instead, it was Sony who implemented that idea (because somebody at Sony had the same idea).

My brother had the idea of Airbnb years before it existed (it was going to be called Travellissimo). I thought of a phone app for dates with locals, even before people had internet on their phones (by creating a local hotspot to communicate with people in the WiFi range). It was going to be called Ligotin.

Ideas per se are worthless. What matters is the implementation of ideas. You can get tons of good ideas. I have seen many people with very good ideas.

However, investors will not invest in your idea unless you have personal connections to important investors (because they are your friends) or you have demonstrated that you can make an idea into a million-dollar business.

Breaking the circle

If just having the idea is worth nothing, how can we break the circle of not having money to finance the initial startup stage?

One option is to run your startup as a side project. This means that you and your co-founders have jobs that pay your bills (house, food, transportation, etc.) and the required materials, travel, and so on for the startup.

At the beginning of The Construct, we each had another job that paid our bills. So we started like that while maturing the idea and building the first Minimum Viable Product (MVP).

The problem with that approach is that it gives you very little time to work on your startup. First, you have to deliver at your job, and then, when you have finished that, you have to go and work on the startup. That is exhausting!

Well, welcome to the startup world! You must also know that if you plan to have a startup for the next few years, that kind of exhaustion will be your life (whether you get financing or not, you will have to work like you never did before!).

So the problem is not that you have to work so many hours, but that very few of those hours are applied to your startup. As a result, your startup will move very slowly. If that is okay with you, your co-founders, and your idea (for example, nobody else in the world can do the same 10 times faster by putting all the effort into it), then this approach is okay.

However, I think that this is never the case in robotics. If you take too much time, somebody else will appear with the same product idea and take you out of business before you even have a minimum viable product.

At The Construct, we started this way, but after a few months of working like that, and once we published our first MVP (which was a complete disaster), we decided that we needed to do more work and move faster. So then, each of us left our jobs and started working for the company. To do that, we had to move to one of the first financing stages of any startup: getting money from fools, friends, and family.

Fools, Friends, and Family, the Three Fs

This stage means you will ask for money from all the people around you who love you and support you in whatever you do. Usually, this means investing the savings you and your co-founders have, asking for money from your close family, like parents, brothers, and lovers, and asking for money from those friends that would do whatever for you. Poor fools!

Then you use this money to build an MVP, a proof of concept that your idea will work, and by work, I don’t mean in the engineering sense (I’m almost 100% sure your idea will work in that sense, that is not the problem). The problem is that it should work in business terms if somebody is willing to pay for it and is willing to pay enough to build a sustainable business.

The chances are that your first iteration of the MVP will not work. So you will have to iterate, modify it, and try again. We will discuss this process in detail in future episodes.

So you will have to take that into account when you are planning your money and the many iterations that you will need before you hit the point where there is business.

How many iterations will you need? Nobody knows. Maybe one, maybe a hundred.

So you have to save as much as possible from that initial money that you have.

Actually, the startup life consists of searching for a sustainable business model in iterations, until you find a good spot or run out of money.

All this means that your money must be managed appropriately to achieve an MVP that shows some business opportunity.

If you reach that point, then you can go to the next point, which is a seed round for your startup from a business angel.

But before going into that, what can you do if you spend all the money and reach no point? Well, you can close your startup and apologize to all those who lend you money. Or you can search for an accelerator.

Accelerators

Accelerators are places that give startups a small amount of money to keep moving, as well as space to work and mentoring from experts to move your idea to the point of MVP faster. In exchange, they usually request a percentage of your company. The amount of money they give and the percentage they take depends on the accelerator.

One of the most famous accelerators is Y Combinator, which has accelerated companies like Dropbox, Stripe, Airbnb, Twitch, and Reddit. They invest $115K for 7% of the company.

I do not recommend accelerators unless you apply to Y combinator or something similar. Or unless you are so desperate and really believe this could fly. The reason is that you can find more accelerators than Starbucks in the last few years. There is one on every corner. And usually, they don’t provide a good service, just a space to stay and a little money. So the acceleration is almost nonexistent. It is more of a survival kit.

By acceleration, I mean a team of experts ready to guide you, spot your false assumptions and errors, and point you in a more successful direction. They basically get some part of the company for a little bit of money and free space (shared with many others).

Business Angels

Business Angels are the ones that invest a small amount of money in your startup after they see some possibilities of success in employing your MVP. They will need to see from you a practical demonstration that your product can make millions in the long run.

Business Angels are usually individuals with a lot of money who want to be part of a project they like and think can be successful. For example, Elon Musk was a Tesla Business Angel. He invested his own money in the early stages of Tesla.

Business Angels will also provide mentorship and guidance based on their contacts and experience. They are directly investing their personal money and want to have a say.

The amount of money invested may be around $50K – $200K

The idea here is to use that money to go beyond the MVP and show that there is real traction in your product – that is, that people would like to buy a lot of it. You don’t have to sell a lot, but just show that if you had enough resources, you would improve the product so much that a large market would like to buy.

Investors

At this point, investors come into the picture. They are there to help you scale your existing business into a big business, optimize the processes, grow in size, or attack adjacent markets.

One point I want to clarify is that investors are not only interested in seeing that you generate money. They could also be interested in traction, that is, that you can engage a lot of people because that usually means that at some point in the future, you must be able to convert those people into money by selling them something.

That is, for example, what happened with Google. Google lived many years with money from investors without producing any decent revenue because they engaged a lot of people (we are talking about millions of people). Then, at some point, one of the employees of Google got the idea of the Google ads system, which made them explode in terms of revenue.

In general, investors do not care very much about your business. It is just a piece in their business game. They may impose demanding conditions for the investment and treat your startup like another piece in their portfolio. This means that if they have to sacrifice it for a greater win (for them), they will. So take care with them.

Sometimes you have no other option, especially in hardware companies that need lots of money to build even something simple (robotics is expensive). But then, you have to be prepared to manage them. So that is another task for you as the founder.

Summary – General Path for Investing

The general way of working is as follows:

- You get some initial money from fools, friends, and family to build some pre-idea

- You use the good results from that to show to Business Angels, which will help you build the product to another level of results.

- With those results, you show investors that there is success and that you need their money to scale to win millions. And they invest in you, several rounds.

Bootstrapping

Another option is to bootstrap your company. This means focusing on generating revenue with your product from the beginning, then using that money to pay your salaries and make your startup grow. This has its advantages and its drawbacks.

Advantages: you don’t dedicate time to get the money, so you will not owe somebody else. Instead, you dedicate your time to building the business. You don’t have to deal with investors that do not care about your business. You are basically free.

Disadvantages: you will grow slower. You are in danger that another company builds the same product as you faster because they have more resources.

Bootstrapping is the method that we used at The Construct. However, with bootstrapping, you must always fight to get enough customers to pay the company’s expenses and grow.

Conclusion

The main point you should take home is that no investors will invest in your idea. Instead, they will invest in some early implementation of your idea that has shown potential in one way or another. Because of that, starting a startup is difficult. You need to cut all expenses to the maximum and ask for money from the people close to you. Then use that money with all the care of the world to demonstrate the

The goal with that money is not to build the business but to demonstrate to investors that your idea has real potential to succeed. And success here means winning in a market the size of billions of dollars.

In the next episode, we will talk about the methodology of building the MVP that will validate your idea and lead you to the next phase.

Subscribe to the podcast using any of the following methods

- ROS Developers Podcast on iTunes

- ROS Developers Podcast on Stitcher

- ROS Developers Podcast on Spotify

Or watch the video

Podcast: Play in new window | Download | Embed

SUBSCRIBE NOW: RSS

0 Comments